Learning about Medicare Advantage Plans

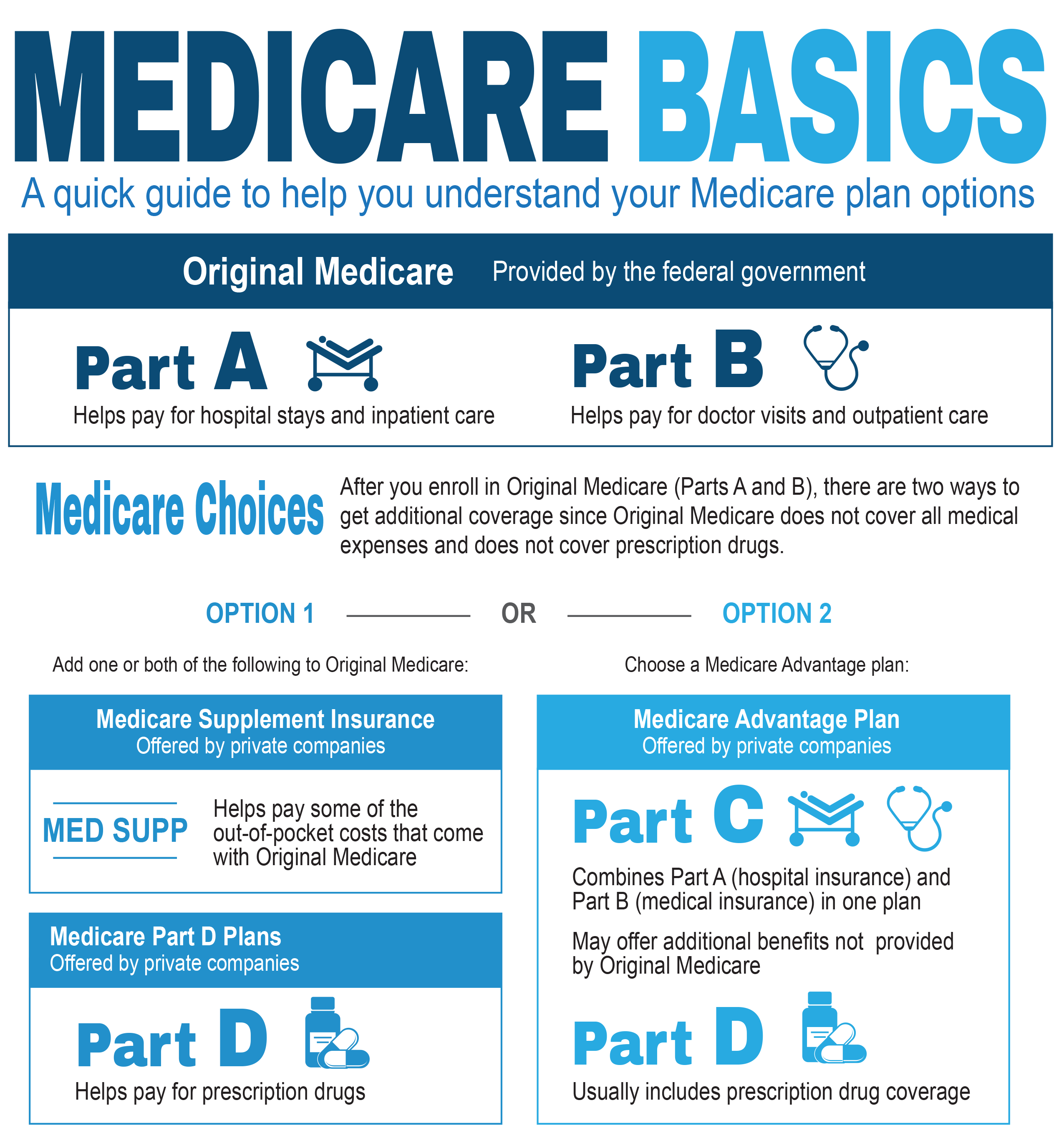

Medicare Advantage Plans are made available by independent Insurance providers that work alongside Medicare to provide Part A and also Part B protection in one coordinated model. Unlike traditional Medicare, Medicare Advantage Plans frequently include PolicyNational.com Medicare Advantage Plans supplemental benefits such as prescription coverage, oral health care, eye care services, along with health support programs. Such Medicare Advantage Plans function within defined coverage regions, which makes geography a important element during evaluation.

Ways Medicare Advantage Plans Differ From Original Medicare

Original Medicare provides open medical professional choice, while Medicare Advantage Plans generally use organized provider networks like HMOs along with PPOs. Medicare Advantage Plans can require referrals and/or network-based facilities, but they frequently balance those limitations with structured expenses. For many enrollees, Medicare Advantage Plans provide a blend between cost control along with expanded services that Traditional Medicare by itself does not typically provide.

Who Might Evaluate Medicare Advantage Plans

Medicare Advantage Plans appeal to people looking for coordinated care together with possible cost savings under a single policy. Seniors handling long-term medical issues often choose Medicare Advantage Plans because connected care models simplify ongoing care. Medicare Advantage Plans can further appeal to enrollees who want packaged services without handling multiple secondary policies.

Eligibility Guidelines for Medicare Advantage Plans

To enroll in Medicare Advantage Plans, participation in Medicare Part A and Part B is required. Medicare Advantage Plans are accessible for most beneficiaries aged sixty-five and older, as well as under-sixty-five people with eligible disabilities. Enrollment in Medicare Advantage Plans relies on living status within a plan’s coverage region as well as enrollment timing that matches authorized enrollment periods.

When to Choose Medicare Advantage Plans

Timing plays a key part when joining Medicare Advantage Plans. The Initial Enrollment Period centers around your Medicare eligibility milestone together with enables initial selection of Medicare Advantage Plans. Missing this window does not automatically end access, but it often alter future options for Medicare Advantage Plans later in the year.

Annual & Qualifying Enrollment Periods

Every fall, the Yearly Enrollment Period permits beneficiaries to change, remove, and/or enroll in Medicare Advantage Plans. Special enrollment windows open when qualifying events occur, such as moving with coverage termination, enabling adjustments to Medicare Advantage Plans beyond the typical schedule. Recognizing these timeframes ensures Medicare Advantage Plans remain available when conditions shift.

How to Review Medicare Advantage Plans Successfully

Evaluating Medicare Advantage Plans requires focus to beyond monthly premiums alone. Medicare Advantage Plans change by network structures, out-of-pocket maximums, drug lists, as well as coverage guidelines. A careful analysis of Medicare Advantage Plans assists matching healthcare requirements with plan designs.

Expenses, Benefits, & Network Networks

Monthly costs, copayments, with annual maximums all shape the value of Medicare Advantage Plans. Some Medicare Advantage Plans feature minimal monthly costs but increased cost-sharing, while alternative options prioritize predictable spending. Provider availability also differs, so making it necessary to verify that regular providers work with the Medicare Advantage Plans under consideration.

Drug Benefits not to mention Extra Benefits

Numerous Medicare Advantage Plans offer Part D drug benefits, easing prescription handling. Beyond medications, Medicare Advantage Plans may cover fitness programs, ride services, alternatively over-the-counter allowances. Reviewing these extras ensures Medicare Advantage Plans align with ongoing healthcare priorities.

Joining Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can take place online, by telephone, and through licensed Insurance professionals. Medicare Advantage Plans require accurate individual details and also confirmation of qualification before coverage activation. Submitting registration properly prevents delays alternatively unplanned benefit gaps within Medicare Advantage Plans.

Understanding the Role of Licensed Insurance Agents

Licensed Insurance Agents help interpret plan specifics along with describe differences among Medicare Advantage Plans. Speaking with an expert can clarify provider network rules, coverage boundaries, and costs linked to Medicare Advantage Plans. Expert assistance commonly simplifies the selection process during enrollment.

Typical Errors to Avoid With Medicare Advantage Plans

Overlooking provider networks details ranks among the frequent issues when selecting Medicare Advantage Plans. A separate challenge centers on focusing only on monthly costs without accounting for overall expenses across Medicare Advantage Plans. Reviewing plan documents carefully helps prevent surprises after sign-up.

Reassessing Medicare Advantage Plans Every Coverage Year

Healthcare priorities evolve, with Medicare Advantage Plans update annually as well. Reviewing Medicare Advantage Plans during annual enrollment allows updates when coverage, expenses, alternatively doctor access shift. Consistent review ensures Medicare Advantage Plans matched with existing medical needs.

Why Medicare Advantage Plans Keep to Increase

Participation patterns indicate growing engagement in Medicare Advantage Plans nationwide. Additional coverage options, structured spending caps, as well as coordinated care contribute to the popularity of Medicare Advantage Plans. As choices expand, well-researched evaluation becomes even more valuable.

Long-Term Benefits of Medicare Advantage Plans

For a large number of enrollees, Medicare Advantage Plans deliver consistency through integrated coverage along with structured care. Medicare Advantage Plans can lower management complexity while supporting preventative services. Choosing suitable Medicare Advantage Plans establishes confidence throughout retirement years.

Evaluate with Enroll in Medicare Advantage Plans Now

Making the right step with Medicare Advantage Plans opens by examining current options not to mention verifying qualification. If you are entering Medicare alternatively revisiting existing benefits, Medicare Advantage Plans offer adaptable solutions built for diverse healthcare needs. Explore Medicare Advantage Plans now to find coverage that supports both your medical needs as well as your budget.